Understanding the February 2025 EUR/USD Exchange Rate

This report analyzes the conversion of €1.50 to US dollars (USD) during February 2025, examining the average exchange rate and the factors influencing its fluctuations. Understanding this conversion is crucial for businesses, investors, and individuals engaging in international transactions. The analysis below provides a clear picture of the EUR/USD exchange rate dynamics during this period and offers actionable insights. For a deeper dive into similar conversions, see this helpful resource.

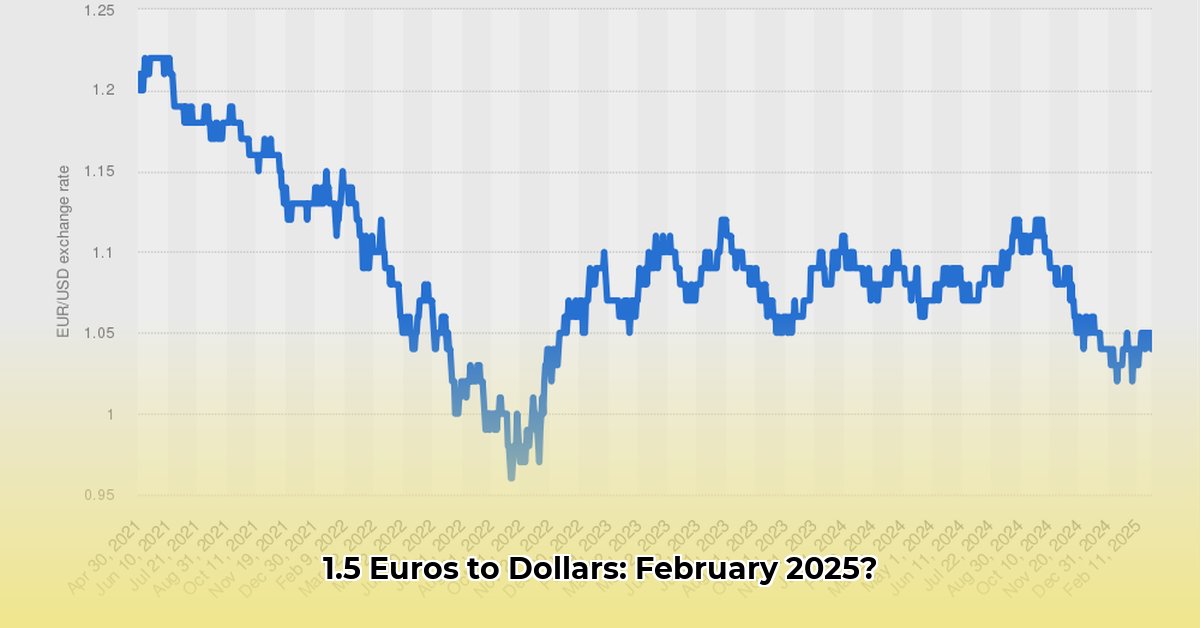

The Average EUR/USD Exchange Rate in February 2025

Throughout February 2025, the EUR/USD exchange rate hovered around an average of 1.05 USD per 1 EUR. This means that, on average, €1.00 was worth approximately $1.05. Consequently, €1.50 would have yielded roughly $1.58. However, daily fluctuations occurred, meaning the precise conversion amount varied slightly depending on the specific transaction date and time. This variability highlights the inherent risk associated with foreign exchange transactions. How significant were these daily variations and what factors contributed to this volatility?

Data Sources and Their Variations

Multiple reputable financial sources corroborated the average exchange rate of approximately 1.05 USD per EUR for February 2025. Yet, subtle differences emerged across these sources due to varied methodologies. Some sources reported a theoretical "mid-market" rate, representing the average buying and selling prices. Others reflected the actual rates offered by banks and currency exchange services, which naturally include profit margins. These minor discrepancies underscore the importance of comparing rates from multiple sources before executing a currency exchange. Did these variations significantly impact the final conversion amount for €1.50?

Macroeconomic Factors Influencing the EUR/USD Exchange Rate

Several macroeconomic factors significantly influenced the EUR/USD exchange rate in February 2025. Interest rate differentials between the United States and the Eurozone played a pivotal role. Higher US interest rates often make the dollar more attractive to investors, increasing its value against the euro. Conversely, higher European interest rates can strengthen the euro.

Geopolitical events also exerted a notable impact. International tensions or political instability can trigger short-term fluctuations. The release of significant economic data, such as employment figures or GDP growth reports, further contributed to the exchange rate's movement. Positive economic news tends to strengthen a currency, whereas negative news typically weakens it. How did these various factors interact to influence the average exchange rate observed in February 2025?

Practical Conversion and Stakeholder Impact

Based on the average February 2025 exchange rate, €1.50 converted to approximately $1.58. However, this is merely an approximation. Obtaining the precise conversion requires accessing the specific exchange rate at the time of the transaction. The implications of this exchange rate varied significantly across different stakeholder groups.

Businesses: International businesses incur foreign exchange risk due to currency fluctuations. This risk impacts profitability and requires strategic management.

Investors: Currency exchange rates affect investment returns on assets denominated in different currencies. Sophisticated portfolio management strategies are often required to handle this risk effectively.

Travelers: Travelers must carefully consider exchange rates when budgeting and making transactions in foreign currencies. Understanding daily fluctuations is crucial for optimizing spending.

Mitigating Foreign Exchange Risk: Strategies and Compliance

Navigating the complexities of foreign exchange requires awareness of inherent risks and appropriate mitigation strategies.

Risk Factors & Mitigation:

Exchange Rate Volatility: This risk can be mitigated through diversification, hedging (using financial instruments like forwards, futures, or options), and stop-loss orders.

Geopolitical Events: Staying updated on geopolitical developments and incorporating such considerations into financial planning can significantly reduce exposure to unexpected shifts in the exchange rate.

Economic News: Monitoring and analyzing economic indicators helps businesses adjust their strategies proactively, adapting to changing market conditions.

Regulatory Changes: Compliance with financial regulations is crucial. Professional legal advice ensures adherence to relevant laws in different jurisdictions.

Regulatory Compliance: Accurate currency conversions are essential for complying with financial reporting, tax, and international transaction regulations. Non-compliance leads to penalties.

Conclusion: Navigating the Dynamic EUR/USD Landscape

The EUR/USD exchange rate in February 2025 reveals the inherent dynamism of the foreign exchange market. While the average exchange rate provided a reasonable estimate for converting €1.50 to USD, understanding the influencing factors and utilizing effective risk management strategies remains paramount for all stakeholders. Continual monitoring of macroeconomic trends and accessing real-time exchange rates are critical for making informed decisions in the ever-changing global financial landscape.